走向大师说

Exam56物流货运代理网专注于国际货运代理、物流行业的深度研究和专项考试分析,帮助小伙伴提升行业的认知和积累。

在当今全球化的经济格局中,贸易政策的一举一动都牵动着众多行业的神经,航空货运市场也不例外。据Freightos的一项深度分析显示,中国进口商品的最低免税资格即将走向取消,这一变化犹如一颗投入湖面的石子,预计将对空运到美国的电子商务商品产生重大影响,使其激增的态势大大减缓。

回溯至2023年底,彼时空运商品持续让飞机处于满载状态,这种情况直接导致了航空货运费率居高不下,给整个行业带来了巨大的成本压力。而此次政策调整带来的后果远不止于此,交货时间将不可避免地延长,对于那些依旧选择空运的商品而言,其价格上涨幅度可能高达50%,这对于相关企业来说无疑是一个严峻的挑战。

美国总统唐纳德·特朗普于2月初宣布暂停豁免,此举措是中国商品征收额外10%关税的新关税计划的一部分。然而,理想很丰满,现实却很骨感。由于海关和邮政服务在基础设施方面存在明显不足,并且缺乏可行的解决方案来有效管理和应对货物数量以及复杂的程序问题,仅仅在本月初,就不得不迅速恢复了中国电子商务进口到美国的最低资格。

在中国的电子商务领域,TEMU和Shein等巨头企业占据着重要地位。它们在很大程度上依赖于通过使用关税最低豁免的方式,从中国直接向美国消费者出口低价值航空货物,从而获得成本上的节省以及运输速度上的优势。面对政策的变化,这两家企业并未坐以待毙,而是已经开始积极谋划,着手为摆脱对最低豁免和航空货物的依赖做好准备。

尽管这些电商巨头行动迅速,但Freightos研究主管Judah Levine指出,这些平台当前正争分夺秒地采取多种策略来适应即将到来的政策变化。它们纷纷提高商品价格,通过各种方式推动卖家增加在美国的库存,同时还会激励制造业向越南以及其他可替代中国生产的国家转移。

Levine在深入分析中表示:“暂时暂停对中国商品的最低关税,这一举措的背后有着深层次的考量。主要是为了让美国海关和边境保护局能够提前做好充分准备,以应对预期中正式入境包裹可能出现的激增情况。但从另一个角度来看,这也为航空货运电子商务进口量减少到更为可控的水平提供了宝贵的时间。”

他还补充道:“已经有相关报道称,一些电子商务公司已经取消了货运航班。”这一现象进一步凸显了此次政策变化对行业的影响之深远。

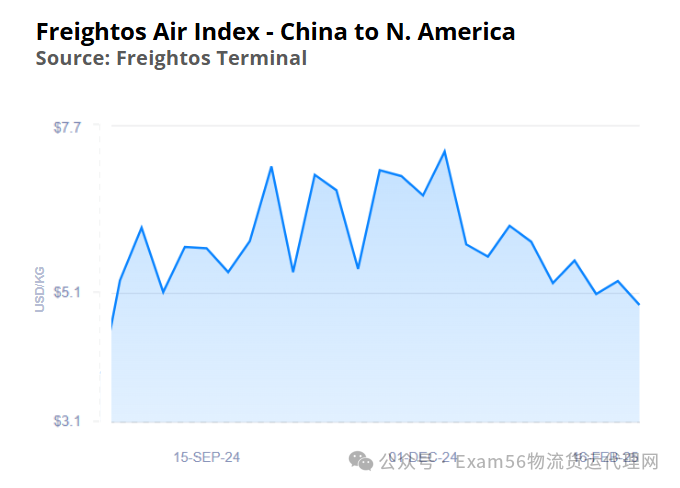

值得关注的是,尽管中美航空运价目前尚未出现崩溃的局面,但根据Freightos航空指数数据显示,自去年8月以来,运价首次跌破了5.00美元/公斤大关,与一周前相比下降了7%。通常情况下,价格在农历新年后会呈现上涨趋势,而此次的下跌无疑反映出了市场的特殊变化。

莱文对此有着自己的见解,他说:“这一趋势透露出一种可能性,即空运价格或许会逐渐下降。在最低关税门槛取消之前,这种下降趋势可能会持续。而一旦相关政策变化正式生效,空运价格则有可能会急剧下降。”

与此同时,在特朗普总统计划的互惠关税实施被推迟后,美国的许多进口商、出口商以及其他各类企业仿佛获得了一丝短暂的喘息机会,尽管他们也都清楚,这可能只是暂时的平静。

2月13日,特朗普签署了一份具有重要意义的备忘录。在这份备忘录中,他明确指示联邦机构要全身心地投入到研究和制定一项全面且系统的计划当中。该计划针对那些对美国出口征收关税,或者对美国企业和贸易设置其他壁垒的国家,将实施互惠关税。

不过,备忘录也明确强调,这些调查工作并非可以随意开展,而是有严格的前提条件。只有在这些机构提交了总统在其广泛的就职日美国优先贸易政策备忘录中所要求的关于美国贸易状况的详细调查结果之后,相关的调查工作才能够正式启动。

莱文进一步指出,随着这些贸易报告——其中很可能包括对特朗普总统提出的对所有中国商品征收60%关税的支持内容——将于4月1日到期,互惠关税行动也只能在此之后才会付诸实施。

他说:“一些专家怀揣着希望,认为这条跑道将为美国贸易伙伴争取到宝贵的时间,以便他们能够及时采取措施降低关税,从而避免遭到美国的报复。”

“然而,这些关税上调的威胁始终如同高悬的达摩克利斯之剑,继续对全球贸易产生着深远的影响。它不仅加速了美国采购从中国等目标国家的转移,还促使托运人从包括墨西哥在内的那些可能很快面临关税上调的国家撤回订单。”

从美国海运市场来看,Freightos的分析揭示了当前的状况。自选举以来,前期装载的进口集装箱量水平以及未来几个月的预测情况都十分明显,海运费率依旧居高不下。其中,西海岸的海运费率约为5000美元/FEU,东海岸则约为6000美元/FEU。即便当前已经进入了跨太平洋集装箱市场的典型淡季,这种高费率的局面依然没有得到缓解。

莱文阐述道:“在不考虑这些关税因素的情况下,随着市场需求的逐渐缓解,亚欧和地中海集装箱运价的下降幅度比跨太平洋农历新年后的下降幅度更为显著。”

自1月初以来,亚欧汇率已下跌近45%,达到了约3000美元/FEU的水平,这是红海危机开始以来的最低水平。与此同时,地中海的日汇率也接近4000美元/FEU的水平。

面对这样复杂多变的市场形势,航空公司也在积极寻求应对之策。据悉,航空公司正在增加空白航班的数量,并且已经宣布3月1日的GRI约为1000美元/FEU,试图通过这种方式将这些航线的费率上调。然而,对于这一举措是否能够成功,不少人表示怀疑。毕竟,在当前诸多不确定因素交织的市场环境下,航空公司的这一决策能否达到预期效果,还有待时间的检验。

Changes to trade policy are shaking up the air cargo market, and the looming cancellation of de minimis eligibility for Chinese imports is expected to significantly reduce the surge of e-commerce goods arriving in the U.S. by air, which has kept planes full and air cargo rates highly elevated since late 2023, according to a new Freightos analysis.

This would also lead to increased delivery times and push price tags up by as much as 50% for items that continue to ship by air.

U.S. President Donald Trump early in February announced the suspension of the exemption as part of new tariffs that impose an additional 10% tax on Chinese goods but later quickly reinstated de minimis eligibility for Chinese e-commerce imports to the U.S. early this month due to the lack of infrastructure and workable solutions for customs and postal services to manage the volume and procedure.

Chinese e-commerce giants like Temu and Shein largely rely on the savings and speed they realize by using the de minimis exemption to export low-value goods by air cargo directly from China to U.S. consumers, and both companies had already begun preparations for a shift away from reliance on de minimis and air cargo.

Judah Levine, head of research at Freightos, noted, nonetheless, that these platforms are scrambling to adjust to the coming policy change by raising prices, pushing sellers to build up US inventories, and incentivizing manufacturing shifts to Vietnam and other China alternatives.

"The temporary reprieve of the de minimis suspension for Chinese goods was aimed to allow US Customs and Border Protection to prepare for an anticipated surge of formal entry parcels, but it may also allow time for air cargo e-commerce import volumes to decrease to a more manageable level," Levine said in the analysis.

"There are already reports of e-commerce companies canceling freighter flights," he added.

The report said that though China - U.S. air cargo rates have yet to collapse, Freightos Air Index data shows they have decreased below the US$5.00/kg mark for the first time since August of last year, and are 7% lower than a week prior though prices typically increase just after Lunar New Year.

"This trend may suggest that air rates could decline gradually up until de minimis is canceled and then more sharply once the change goes into effect," Levine said.

Meanwhile, many importers, exporters, and other businesses in the U.S. are breathing another, though possibly temporary, tariff-related sigh of relief after President Trump’s planned reciprocal tariffs implementation was pushed back.

On February 13, Trump signed a memorandum instructing federal agencies to research and develop a comprehensive plan for reciprocal tariffs on countries with duties on U.S. exports or other barriers to American businesses and trade.

But the memo specifies that those investigations commence only after these agencies submit their findings on the state of American trade that the president requested in his wide-ranging inauguration day America First Trade Policy memo.

Levine noted that with those trade reports – which could include support for President Trump's proposed 60% tariff on all Chinese goods – due on April 1st, reciprocal tariff actions can only come after that.

"Some experts are hopeful that this runway will provide time for U.S. trading partners to lower their tariffs and avoid US reciprocation," he said.

"But the threat of these tariff increases continues to impact global trade both by accelerating the shift of US sourcing away from targeted countries like China and by pushing shippers to pull forward orders from those that could face tariff hikes soon, including Mexico."

The Freightos analysis said for US ocean freight this frontloading remains apparent both in import container volume levels since the election and projections for the coming months and in ocean rates that remain elevated – at about US$5,000/FEU to the West Coast and US$6,000/FEU to the East Coast – even as we enter the typical slow season for the transpacific container market.

"In the absence of these tariff considerations, Asia - Europe and Mediterranean container rates are falling more significantly than on the transpacific post-Lunar New Year as demand eases," Levine said.

Asia - Europe rates have fallen nearly 45% since early January to about US$3,000/FEU, its lowest level since the start of the Red Sea crisis, and daily rates to the Mediterranean are nearing the US$4,000/FEU level.

The analysis said carriers are increasing blanked sailings and have announced March 1st GRIs of about US$1,000/FEU to attempt and push rates back up on these lanes, though there is skepticism that the increases will succeed.

商务合作请点击上方 |