走向大师说

Exam56物流货运代理网专注于国际货运代理、物流行业的深度研究和专项考试分析,帮助小伙伴提升行业的认知和积累。

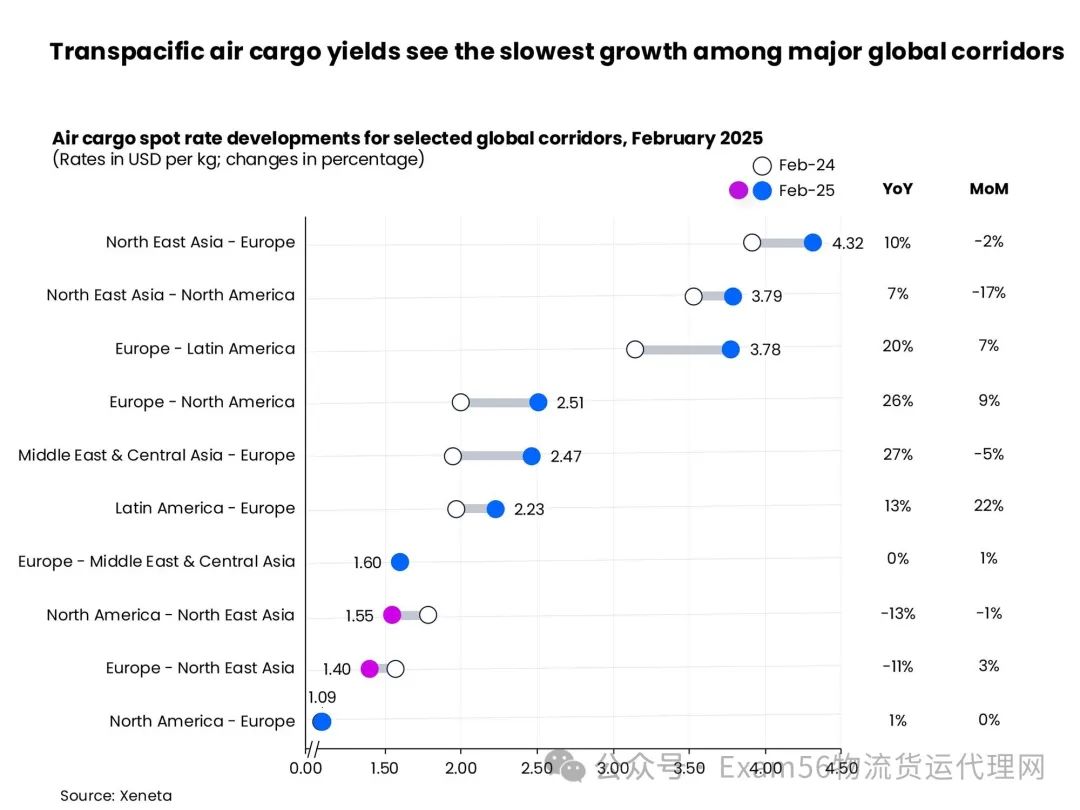

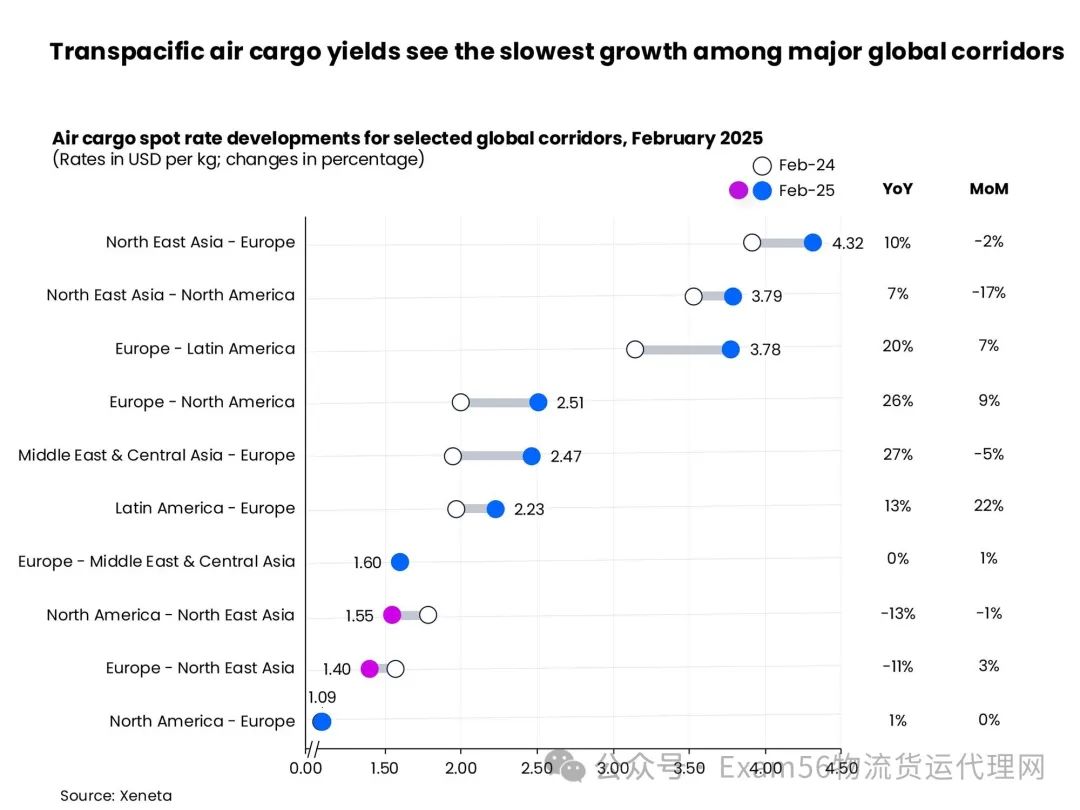

Xeneta的最新行业分析显示,在2月份的全球航空货运市场数据中,一些世界上最大的贸易国之间的“猫捉老鼠”政治游戏可能首次蚕食了国际电子商务量,从上海到美国的现货价格环比下降29%,至每公斤3.23美元。

Xeneta首席航空货运官Niall van de Wouw表示,即使考虑到农历新年早些时候和年初季节性电子商务放缓,在美国暂时取消对中国货物的最低豁免后,上海-美国现货价格的下降可能是“监管/政治对话开始影响航空货运市场”的首批指标之一。

“当电子商务蓬勃发展时,由于出境需求太多,香港和中国南方市场很快就被堵塞了。因此,电子商务市场开始向东进军上海,尽管由于成本增加,它不太理想。”

“如果电子商务量的下降意味着目前有更多的可用能力再次在香港和中国南方开展业务,我们预计上海将成为第一个感受到这种影响的市场,这就是我们在2月份看到的。”

van de Wouw补充道:“这可能是短期的,但电子商务的不确定性正在影响市场。”

相比之下,上海至欧洲的即期汇率仅小幅下降,环比下降2%,至每公斤3.86美元。

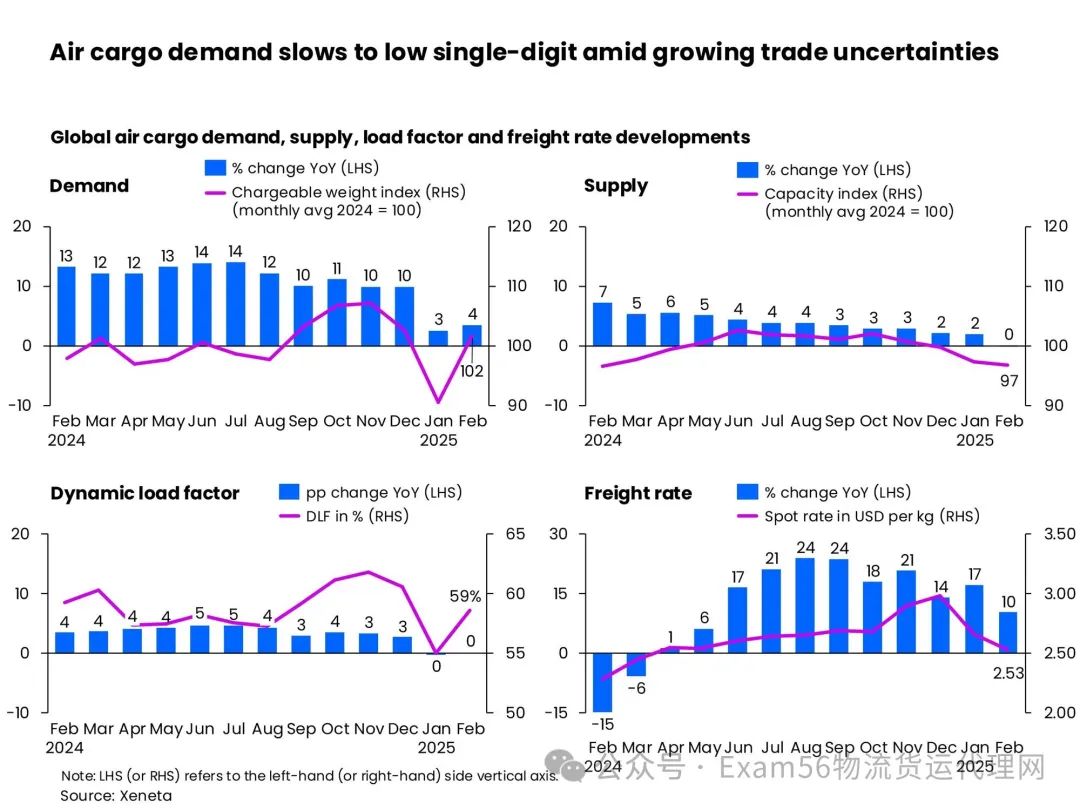

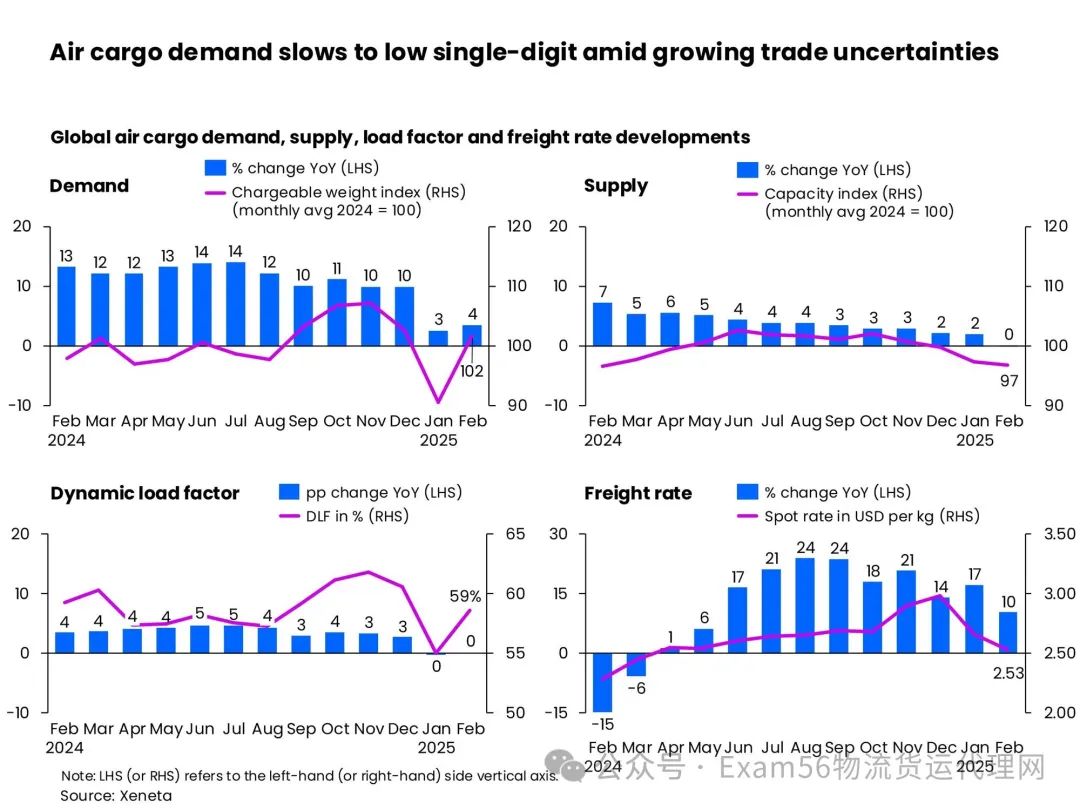

Xeneta报告称,总体而言,2月份全球航空货运需求同比增长4%,与2024年每个月的两位数增长相比持续放缓。

通过调整今年农历新年的时间,1月和2月的航空货运总需求比上年温和增长了3%。

除了美国的“微小变化”外,Xeneta表示,其他可能影响月度业绩的因素包括2024年的高比较基数,以及随着供应链继续适应更长的运输时间,红海中断对航空货运量的影响逐渐减弱。

2月份全球航空货运运力供应也与去年同期持平。

1月和2月的总容量仅微涨1%,而2025年前两个月的动态装载率与一年前相比保持不变,2月份为59%。

动态装载率是Xeneta根据可用舱位旁边的货物体积和重量对舱位利用率的衡量。

与此同时,2月份全球航空货运现货价格(有效期为一个月)同比增速为2024年6月以来的最低水平,上涨10%,达到每公斤2.53美元。

相比之下,Xeneta指出,全球季节性价格(有效期超过一个月)同比下降1%,至每公斤2.21美元,反映了市场供需动态的变化。

全球航空货运现货价格环比下降5%。

展望2025年,Xeneta预测,继2024年表现强劲之后,全球航空货运市场将增长4-6%。

范德沃表示:“自那以后,贸易紧张局势的加剧给市场前景带来了很大的问号。”。

他补充道:“随着近年来普通货物需求的低迷,电子商务的激增一直是航空货运市场表现的救星。如果现在受到重大打击,如果发生这种情况,将对全球航空货运价格产生深远影响。”。

目前,Xeneta航空货运主管指出,大型电子商务企业和普通货物托运人正在购买时间而不是货运能力,以避免可能带来额外财务风险的承诺。

“从我们听到的对话来看,一些托运人显然在寻找将美国关税影响降至最低的方法,而另一些托运人则预计,如果电子商务量持续下降,空运价格会降低。”

这也将对其他市场产生连锁反应。

范德武说:“例如,如果我现在从越南运往美国,我会担心如果更多的托运人来到这条走廊,以减轻关税对中国直接运往美国的影响,会对价格产生影响。”。

使问题更加复杂的是,美国拟议对中国制造的船舶收取港口停靠费,这可能会在短期内使远洋运输时间表陷入混乱,推高集装箱运费,甚至促使从海运转向空运。

特朗普政府在美国征收的关税和期待已久的国际反应正在全球航空货运市场引发越来越大的连锁反应。

Xeneta表示,这促使主要利益相关者做出调整。例如,航空公司目前正在重新评估其货运能力战略,许多航空公司选择将航线转向东南亚而不是中国,或者将运力重新定位到跨大西洋市场。一些托运人还将从2025年第二季度开始推迟年度合同谈判,同时选择在今年上半年签订短期协议。

van de Wouw说:“这种情况完全超出了航空货运市场的控制范围,而且噪音很大,这增加了利益相关者的焦虑。”。

他补充道:“问题是没有人知道最终的结果是什么,从监管的角度来看会发生什么,以及这将如何影响消费者信心。”。

The political game of 'cat and mouse' between some of the world's biggest trading nations may have taken its first nibble at international e-commerce volumes in February's global air cargo market data, with spot rates from Shanghai to the US dropping 29% month-on-month to US$3.23 per kg, according to the latest industry analysis by Xeneta.

Niall van de Wouw, chief airfreight officer at Xeneta, said even allowing for the earlier Lunar New Year and the seasonal e-commerce slowdown at the start of the year, the fall in Shanghai-US spot rates, following the United States' temporary removal of the de minimis exemption on Chinese shipments, may be one of the first indicators that "the regulatory/political conversations are starting to affect the air cargo market."

"When the e-commerce boom took off, it very quickly clogged up the Hong Kong and southern China market because of so much outbound demand. So, the e-commerce market started to venture eastwards to Shanghai, even though it was less desirable due to additional cost."

"If a fall in e-commerce volumes means there's currently more available capacity to do business out of Hong Kong and southern China again, we would expect Shanghai to be the first market to feel this impact, and that's what we saw in February."

van de Wouw added: "This may be short-term, but the uncertainty around e-commerce is impacting the market."

In comparison, the Shanghai-to-Europe spot rate declined only modestly, or 2% month over month, to US$3.86 per kg.

The Xeneta report said overall, global air cargo demand grew by 4% year-on-year in February, marking a continued slowdown from the double-digit growth seen in every month of 2024.

By adjusting the timing of this year's Lunar New Year, the total air cargo demand for January and February increased by a modest 3% compared to the previous year.

In addition to the US "de minimis change," Xeneta said other factors likely influencing the monthly performance included a high comparison base in 2024 and the diminishing impact of Red Sea disruptions on air cargo volumes as supply chains continued to adapt to longer transit times.

Supply of global air cargo capacity in February also stayed flat compared to a year ago.

The combined January and February capacity edged up by just 1%, while the dynamic load factor for the first two months of 2025 remained unchanged from a year ago at 59% in February.

Dynamic load factor is Xeneta's measurement of capacity utilisation based on the volume and weight of cargo flown alongside available capacity.

Meanwhile, the global air cargo spot rate (valid for one month) in February increased at its slowest pace year-on-year since June 2024, rising by 10% to US$2.53 per kg.

In contrast, Xeneta noted that the global seasonal rate (valid for longer than one month) dropped 1% year-on-year to US$2.21 per kg, reflecting the market's changing supply/demand dynamics.

Month-on-month, the global air cargo spot rate declined by 5%.

Heading into 2025, Xeneta was forecasting a year of 4-6% growth in the global air cargo market after its strong performance in 2024.

"Growing trade tension since then now places a big question mark over the market’s outlook," van de Wouw said.

"With general cargo demand in the doldrums in recent years, the surge in e-commerce has been the saviour of the air cargo market performance. If this now takes a significant hit, if that happens, it will have a profound effect on airfreight rates around the world," he added.

For now, the Xeneta airfreight chief noted that the big e-commerce players and general cargo shippers are buying time instead of cargo capacity to avoid commitments that might bring added financial risk.

"From the conversations we are hearing, some shippers are clearly looking for ways to minimise the impact of US tariffs, while others will be anticipating lower airfreight rates if e-commerce volumes show a sustained dip."

This is also going to have a knock-on impact on other markets.

"If I was shipping ex-Vietnam to the US right now, for example, I'd be concerned about the impact on rates if more shippers descend on this corridor to lessen the impact caused by tariffs on direct shipments from China to the US," van de Wouw said.

Further complicating the matter is the proposed US port call fees on Chinese-built ships, which could throw ocean shipping schedules into disarray in the short term, driving up container freight rates and even prompting a shift from sea to air.

The tariffs imposed by the Trump administration in the US and the awaited international response are causing increasing ripple effects across the global air cargo market.

Xeneta said this is prompting adjustments from key stakeholders. Airlines, for example, are currently reassessing their freighter capacity strategies, with many opting to shift routes toward Southeast Asia rather than China or repositioning capacity to the Transatlantic market. Some shippers also are postponing annual contract negotiations from Q2 2025 while opting for shorter-term agreements in the first half of the year.

"This is a situation completely outside of the control of the air cargo market and there's a great deal of noise, which is adding to stakeholders' anxiety," van de Wouw said.

"The issue is no one knows what the end game is, and what's going to happen from a regulatory perspective, and how this will impact consumer confidence," he added.

商务合作请点击上方 |