走向大师说

Exam56物流货运代理网专注于国际货运代理、物流行业的深度研究和专项考试分析,帮助小伙伴提升行业的认知和积累。

《DHL贸易地图集2025》的结果显示,在世界上一些最大经济体因不断升级的贸易紧张局势而引发近期中断的情况下,全球贸易增长展现出了令人惊叹的弹性。

这家德国物流巨头明确表示,即便美国开始对包括中国、加拿大和墨西哥等在内的一些最大贸易伙伴提高关税,这种贸易增长的模式“仍有可能持续下去”。

DHL与纽约大学斯特恩商学院(NYU Stern)携手发布的《DHL贸易地图集》指出,尽管当前市场存在诸多风险,但全球贸易在2024年实现了复苏,而且预计在未来五年内,其增长速度将快于过去十年。

报告中提到:“即便美国新政府实施了所有拟议的关税上调举措,且其他国家也进行了报复行动,预计未来五年全球贸易仍将保持增长态势,只不过增长速度会大幅放缓。”

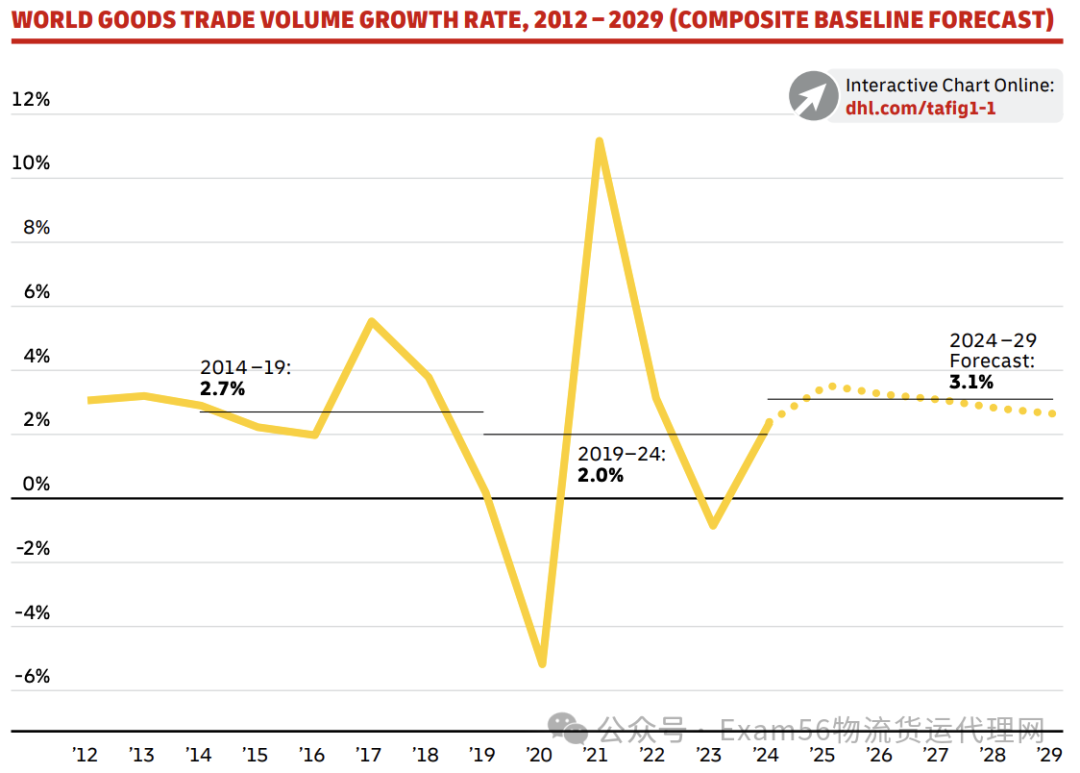

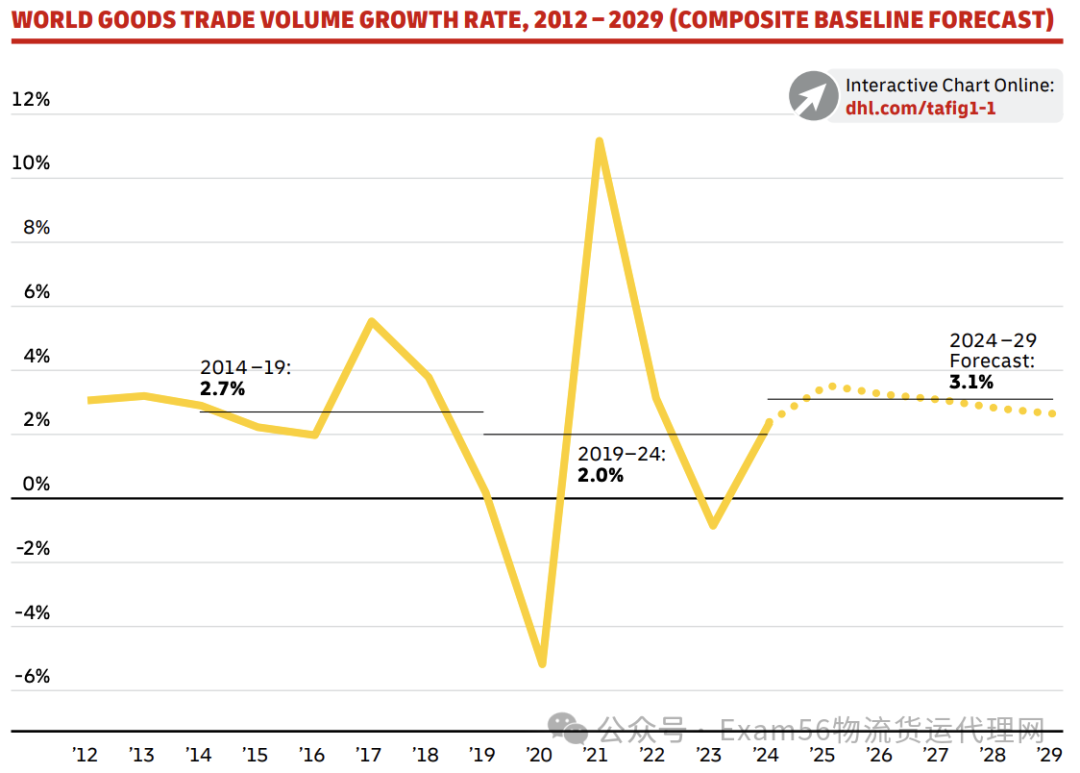

近期的预测显示,从2024年到2029年期间,货物贸易将以3.1%的复合年增长率实现增长。这一增长率与GDP增长大致相符,意味着相较于前十年,贸易增长略有加快。

DHL Express首席执行官John Pearson表示:“《DHL贸易地图集2025》揭示了一系列令人鼓舞的见解。无论是全球发达经济体还是新兴经济体,其贸易增长潜力都极为可观。”

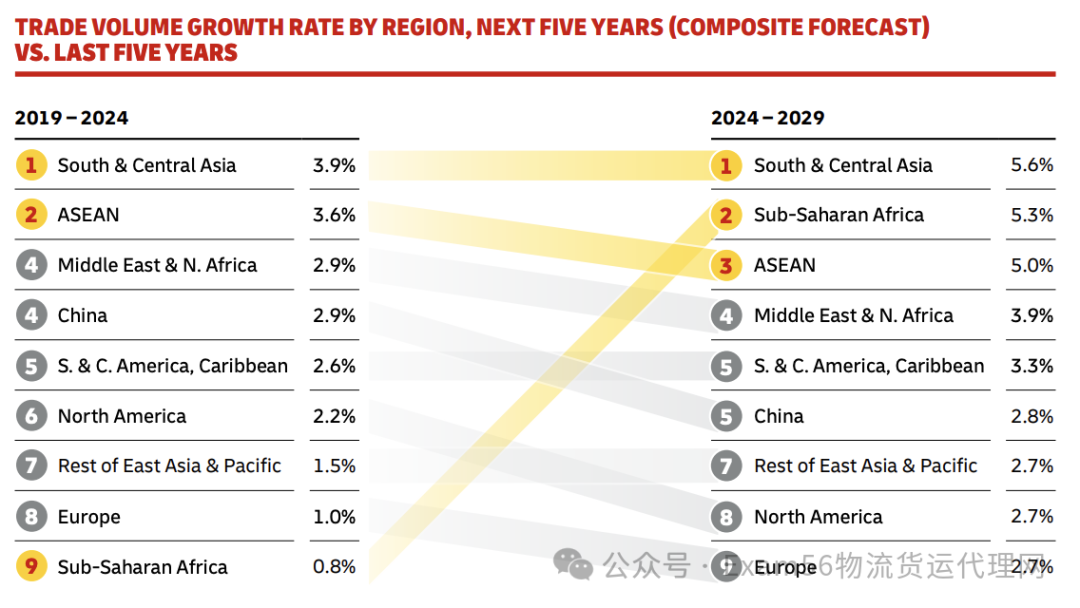

印度、越南、印度尼西亚以及菲律宾将成为贸易增长的引领者

随着供应链的持续发展,《DHL贸易地图集2025》确定了“贸易增长的新领导者”。

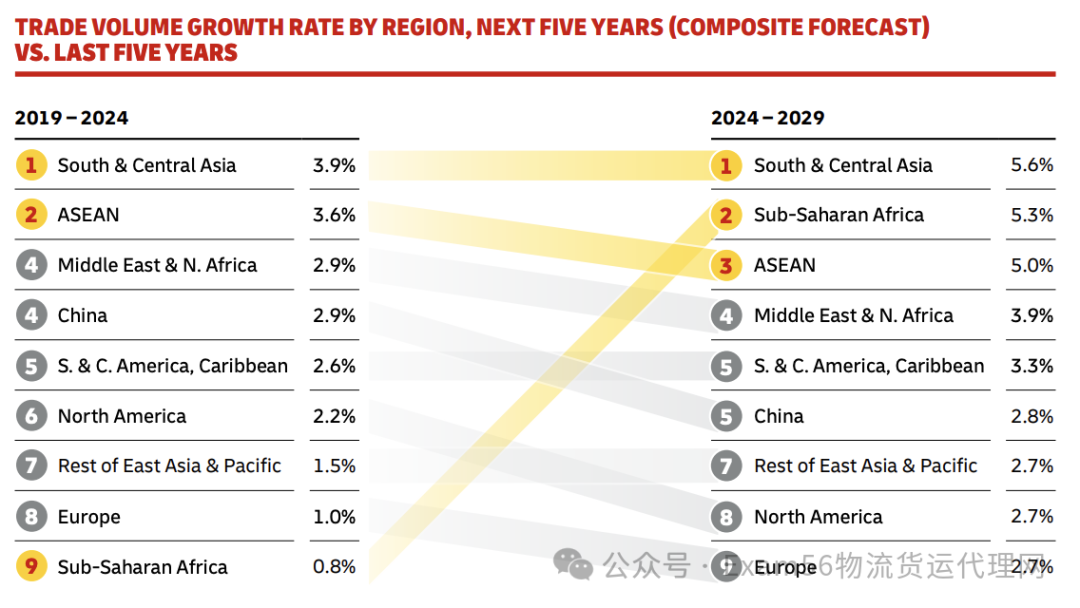

报告称,在2024年至2029年这段时间里,印度、越南、印度尼西亚和菲律宾预计将在贸易增长速度(增长率)和规模(绝对金额)方面跻身前30名之列。

其中,印度是绝对预测贸易增长第三大的国家(占全球额外贸易的6%),仅次于中国(12%)和美国(10%)。

报告还指出:“预计将实现最绝对贸易增长的国家分布在亚洲、欧洲和北美地区。同时,预计贸易增长最快的国家还包括非洲和拉丁美洲的几个国家。”而其他地区预计将以2%至4%的速度实现增长。

美国政策转变虽有影响,但不会阻碍全球贸易发展

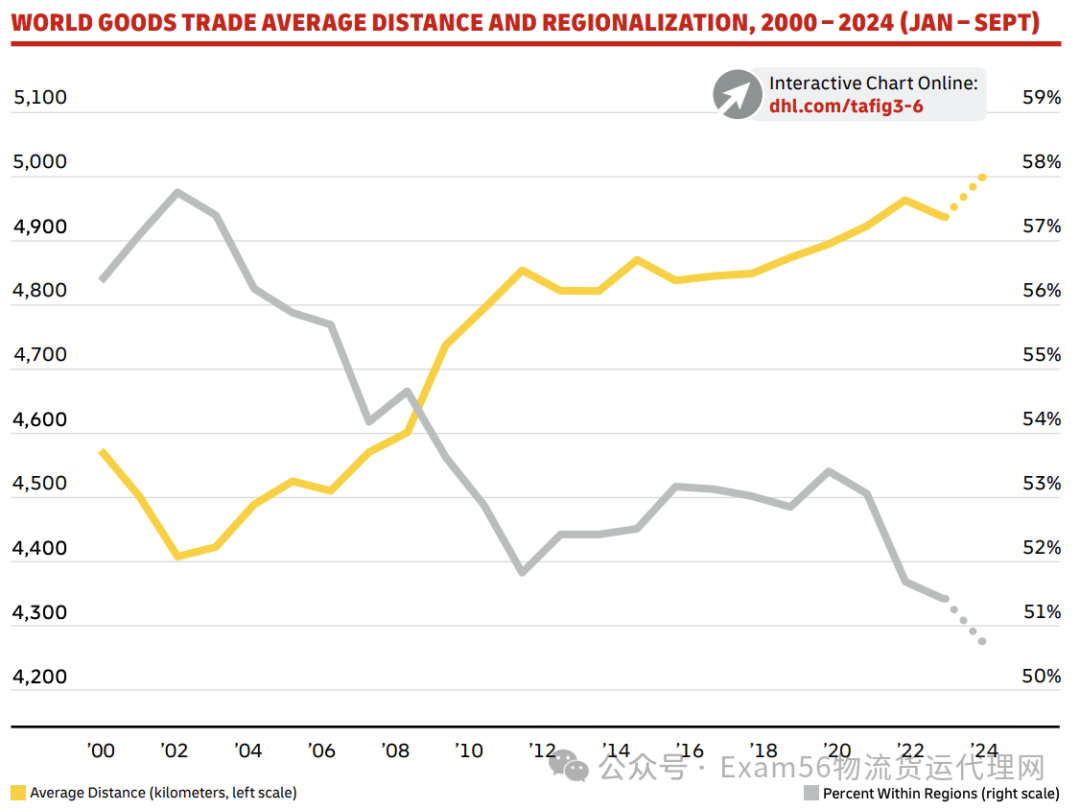

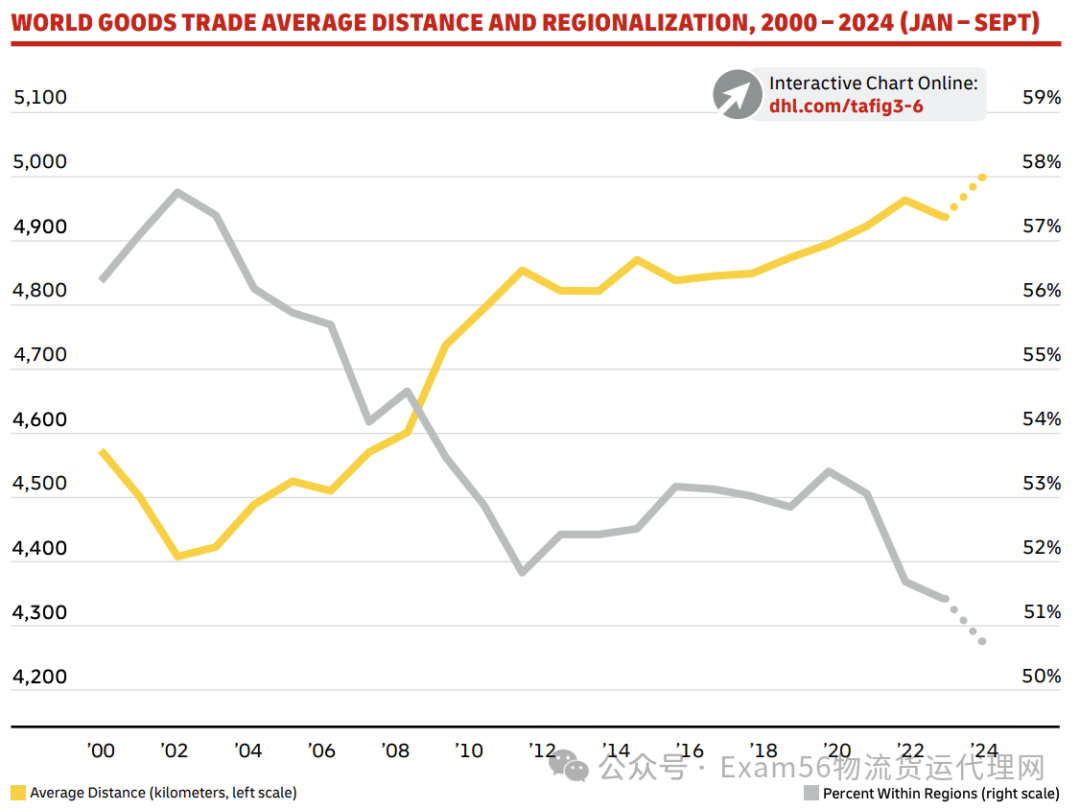

尽管人们普遍对近岸生产和让货物离客户更近的做法感兴趣,但《DHL贸易地图集2025》却发现,贸易“总体上并未变得更加区域化”。

报告表示:“实际贸易流量呈现出了相反的趋势。”它还补充说,在2024年的前九个月,所有贸易货物的平均运输距离达到了创纪录的5000公里,而主要地区内的贸易份额则降至51%的新低。

与此同时,《DHL贸易地图集》的最新版本列举了几个乐观的理由,以应对美国总统唐纳德·特朗普去年连任后美国政策的转变以及未来贸易政策的不确定性。

报告称,“大多数国家依旧将贸易视为关键的经济机遇,美国的贸易壁垒或许会加强其他国家之间的联系”,并补充说,特朗普的许多关税威胁最终可能会与最初提出的有所不同,或者为防止国内通胀飙升而被推迟。

“此外,美国在世界进口中的份额目前为13%,在出口中的份额为9%——这一比例足以让美国的政策对其他国家产生实质性影响,但还不足以单方面决定全球贸易的未来走向。”报告进一步补充道。

纽约大学斯特恩未来管理中心高级研究学者兼DHL全球化倡议主任Steven A. Altman指出,虽然必须认真对待全球贸易体系所面临的威胁,但全球贸易因其为经济和社会带来的巨大利益而展现出了强大的弹性。

他说:“虽然美国有可能会退出贸易,但代价高昂,而其他国家不太可能像美国那样行事,因为在全球贸易格局发生变动的情况下,小国将会遭受更为严重的损失。”

该报告还指出,有证据表明,美中贸易冲突“并未大幅削减美国对中国商品的依赖程度”,因为它引用了地缘政治驱动的贸易模式转变的最新情况。

《DHL贸易地图集2025》发现,尽管美国和中国的亲密盟友集团之间的贸易在2022年和2023年相对于这些集团内部的贸易有所下降,但这些下降幅度十分微小,而且在2024年并未继续扩大。

报告称:“美国和中国已经减少了彼此的贸易份额,但这种减少还不足以构成真正意义上的‘脱钩’。”

美中直接贸易从2016年占世界贸易的3.5%下降到2024年前九个月的2.6%。然而,美国从中国进口的份额仍然与世界其他地区一样高。

报告还提到:“有证据表明,美国从中国进口的商品存在被低估的情况。

此外,考虑到中国对美国从其他国家进口的商品的投入数据表明,美国对中国制造商品的依赖并未明显下降。”

DHL和纽约大学斯特恩商学院发布了新的《DHL贸易增长地图集》,该地图集描绘了全球货物贸易最重要的趋势和前景。这份报告涵盖了近200个国家和地区,占世界贸易、国内生产总值和人口的99%以上。DHL委托编制的这份报告于2025年2月完成,使用了截至2025年1月的数据和预测更新。

2022年,《DHL贸易增长图谱》发现,全球贸易量保持强劲态势,在新冠肺炎疫情以及地缘政治和经济冲击过后迅速实现反弹。

Global trade growth has proven surprisingly resilient in the face of recent disruptions triggered by escalating trade tensions in some of the world's largest economies, according to results of the DHL Trade Atlas 2025.

The German logistics giant said this pattern is "likely to continue" even as the U.S. begins a campaign of tariff increases against some of its biggest trading partners, including China, Canada, and Mexico.

The DHL Trade Atlas, published by DHL in collaboration with the New York University Stern Business School (NYU Stern), said that global trade recovered in 2024 and is forecasted to grow faster over the next five years than during the preceding decade despite current market risks.

"Even if the new U.S. administration implements all of its proposed tariff increases and other countries retaliate, global trade is still expected to grow over the next five years – but at a much slower pace," the report said.

Recent forecasts predict that goods trade will grow at a compound annual rate of 3.1% from 2024 to 2029. This roughly aligns with GDP growth and represents modestly faster trade growth than the previous decade.

"The DHL Trade Atlas 2025 reveals highly encouraging insights," said John Pearson, CEO, DHL Express. "There is still significant potential for trade growth in advanced and emerging economies worldwide."

India, Vietnam, Indonesia, the Philippines to lead trade growth

The DHL Trade Atlas 2025 identified "new leaders in trade growth" as supply chains continue to evolve.

It said that between 2024 and 2029, India, Vietnam, Indonesia, and the Philippines are forecast to rank among the top 30 for both speed (growth rate) and scale (absolute amount) of trade growth.

India also stands out as the country with the third-largest absolute forecast trade growth (6% of additional global trade), behind China (12%) and the United States (10%).

"The countries expected to deliver the most absolute trade growth are spread across Asia, Europe, and North America," the report said, adding that at the same time, the countries with the fastest projected trade growth also include several in Africa and Latin America.

All other regions are forecast to grow at rates of 2% to 4%.

U.S. policy shifts to impact but not deter global trade

Despite widespread interest in nearshoring and producing goods closer to customers, the DHL Trade Atlas 2025 also found that trade "has not become more regionalized overall."

"Actual trade flows indicate the opposite trend," it said, adding that in the first nine months of 2024, the average distance traversed for all traded goods reached a record 5,000 kilometers, while the share of trade within major regions fell to a new low of 51%.

Meanwhile, the latest iteration of the DHL Trade Atlas cited several reasons for optimism in the face of the U.S. policy shifts and uncertainty over future trade policies following U.S. President Donald Trump's re-election last year.

"Most countries continue to pursue trade as a key economic opportunity, and U.S. trade barriers could strengthen ties among other countries," the report said, adding that many of Trump’s tariff threats may end up different than originally proposed or delayed to prevent a spike in domestic inflation.

"Moreover, the U.S. share of world imports currently stands at 13%, and its share of exports is 9% – enough for U.S. policies to have substantial effects on other countries but not enough to unilaterally determine the future of global trade," it added.

Steven A. Altman, senior research scholar and director of the DHL Initiative on Globalization at NYU Stern's Center for the Future of Management, noted that while threats to the global trading system must be taken seriously, global trade has shown great resilience because of the large benefits that it delivers for economies and societies.

"While the U.S. could pull back from trade – at a significant cost – other countries are not likely to follow the U.S. down that path because smaller countries would suffer even more in a global retreat from trade," he said.

The report also pointed out evidence suggesting that the U.S.–China trade conflict "has not substantially cut U.S. reliance on Chinese goods," as it cited an update on geopolitically driven shifts in trade patterns.

The DHL Trade Atlas 2025 found that while trade between blocs of close allies of the U.S. and China declined in 2022 and 2023 relative to trade within these blocs, those declines were minor and did not continue in 2024.

"The U.S. and China have reduced their shares of trade with each other, but not enough to constitute a meaningful 'decoupling,'" the report said.

Direct U.S.–China trade has fallen from 3.5% of world trade in 2016 to 2.6% over the first nine months of 2024. However, the U.S. still brings in as high a share of its imports from China as the rest of the world does.

"There is [also] evidence suggesting that U.S. imports from China are underreported. Moreover, data that also considers Chinese inputs in goods the U.S. imports from other countries suggests no meaningful drop in U.S. reliance on goods made in China."

DHL and NYU Stern School of Business published the new DHL Trade Growth Atlas, which maps the most important trends and prospects of global trade in goods. The report covers nearly 200 countries and territories that comprise over 99% of world trade, GDP, and population. The report commissioned by DHL was finalized in February 2025 using data and forecast updates through January 2025.

In 2022, the DHL Trade Growth Atlas found that global trade volumes stayed strong, bouncing back quickly following the COVID-19 pandemic and geopolitical and economic shocks.

商务合作请点击上方 |