走向大师说

Exam56物流货运代理网专注于国际货运代理、物流行业的深度研究和专项考试分析,帮助小伙伴提升行业的认知和积累。

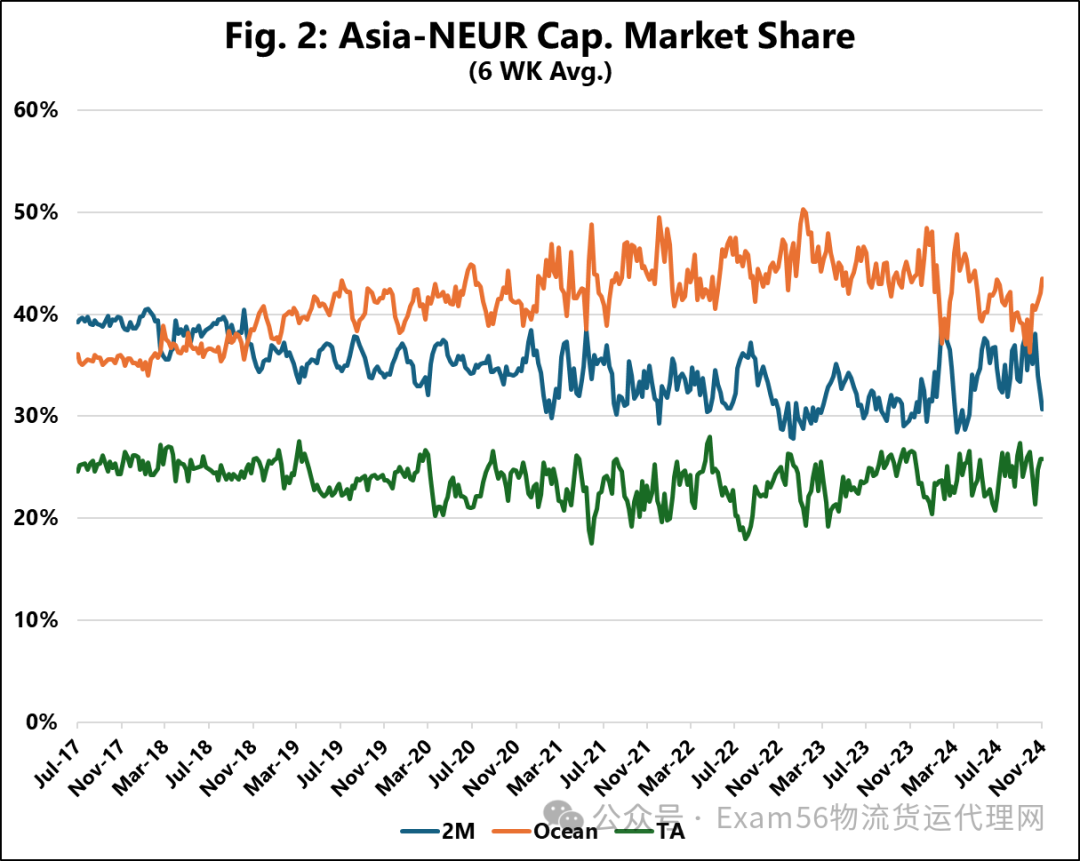

根据海洋情报公司的一项最新分析显示,由达飞海运集团、中远集装箱航运公司、长荣航运公司和东方海外集装箱航运公司组成的海洋联盟,在2017年4月至2024年11月期间,成功保持了亚洲至北美西海岸(Asia NAWC)以及亚洲至北欧(Asia NEUR)航线的最高运力市场份额。

丹麦的海事数据分析公司指出,运力市场份额是一个“非常有趣的指标”,它能够衡量承运人联盟在任何特定贸易路线上的存在感和影响力。

海洋情报公司的首席执行官Alan Murphy表示:“在亚洲至北美西海岸的航线上,海洋联盟无疑是部署容量最大的航母联盟,其运力高达200万艘。”他进一步补充道:“此外,在整个现有结构的生命周期内,几乎没有任何迹象表明市场动态发生了变化。”

自2015年以来,2M联盟一直由MSC和马士基共同运营。然而,经过近八年的合作后,该联盟将于2025年2月进行重组。届时,马士基和赫伯罗特将成立Gemini Cooperation,而MSC则选择独立运营,但会在某些贸易航线上建立新的战略合作伙伴关系。

与此同时,海洋情报局指出,赫伯罗特、ONE、HMM和阳明海运之间的联盟近几个月来已经占据了更多的产能市场份额,并且正在逐渐接近海洋联盟的地位。特别是在亚洲至北欧的航线上,海洋联盟在2018年底超过了200万的容量市场份额,并一直保持着这一领先地位。

墨菲说:“从那时起,海洋联盟就一直保持着最高的容量市场份额,始终维持在200万左右。”他补充道:“另一方面,其他联盟的市场战略明显不同,它们始终保持着相对较低的产能市场份额。”

The Ocean Alliance — composed of members CMA CGM, COSCO Container Lines, Evergreen Line, and Orient Overseas Container Line (OOCL) —maintained the highest capacity market share for both the Asia-North America West Coast (Asia-NAWC) and Asia-North Europe (Asia-NEUR) lane between April 2017 and November 2024, according to a new analysis by Sea-Intelligence.

The Danish maritime data analysis firm noted that capacity market share is an "interesting metric" to see the extent of the presence of a carrier alliance in any given trade.

"On Asia-NAWC, Ocean Alliance has by far been the most dominant carrier alliance in terms of deployed capacity, with 2M on the other end," said Alan Murphy, CEO of Sea-Intelligence.

"Furthermore, throughout the life cycle of the existing structure, there has hardly been any movement indicating a change in market dynamics," he added.

2M Alliance has been operated by MSC and Maersk since 2015, but after nearly eight years, it will be reorganised in February 2025. Maersk and Hapag-Lloyd will form Gemini Cooperation, and MSC will opt to operate independently but with new strategic partnerships on certain trade lanes.

Meanwhile, Sea-Intelligence noted that THE Alliance — between Hapag-Lloyd, ONE, HMM, and Yang Ming — has, in recent months, captured more capacity market share and is closing in on Ocean Alliance.

On Asia-NEUR, Ocean Alliance overtook 2M by the end of 2018 as they increased their capacity market share.

"Since then, Ocean Alliance has maintained the highest capacity market share, with 2M close by," Murphy said.

"THE Alliance, on the other hand, has a clearly different market strategy, maintaining the lowest capacity market share throughout," he added.

商务合作请点击上方 |